Maximize Your Forex Bargains: Currency Exchange in Toronto Revealed

Wiki Article

Exactly How to Optimize Your Profits With Currency Exchange Approaches

In the dynamic world of money exchange, strategic decision-making can considerably influence your lower line. As we dive better right into the world of currency exchange strategies, revealing the nuances of each facet can pave the means for an extra successful endeavor.Understanding Money Markets

In the realm of global money, comprehending the elaborate workings of money markets is paramount for tactical decision-making and investment success. Currency markets are vibrant and affected by a myriad of variables, consisting of economic indicators, geopolitical occasions, and market belief. Recognizing just how these variables influence currency exchange rate is essential for services and capitalists seeking to make best use of earnings through money exchange techniques.Financiers and traders analyze these elements to anticipate potential currency movements and make informed choices. A country with solid financial information and steady political conditions might experience a conditioning of its currency against others.

Moreover, money markets run 1 day a day, five days a week, enabling constant trading and reacting to worldwide occasions in real-time. This continuous activity offers possibilities for earnings yet additionally requires caution and a deep understanding of market characteristics to navigate successfully. By grasping the nuances of money services, individuals and markets can establish effective techniques to hedge dangers and take advantage of on market opportunities.

Identifying Profitable Exchange Opportunities

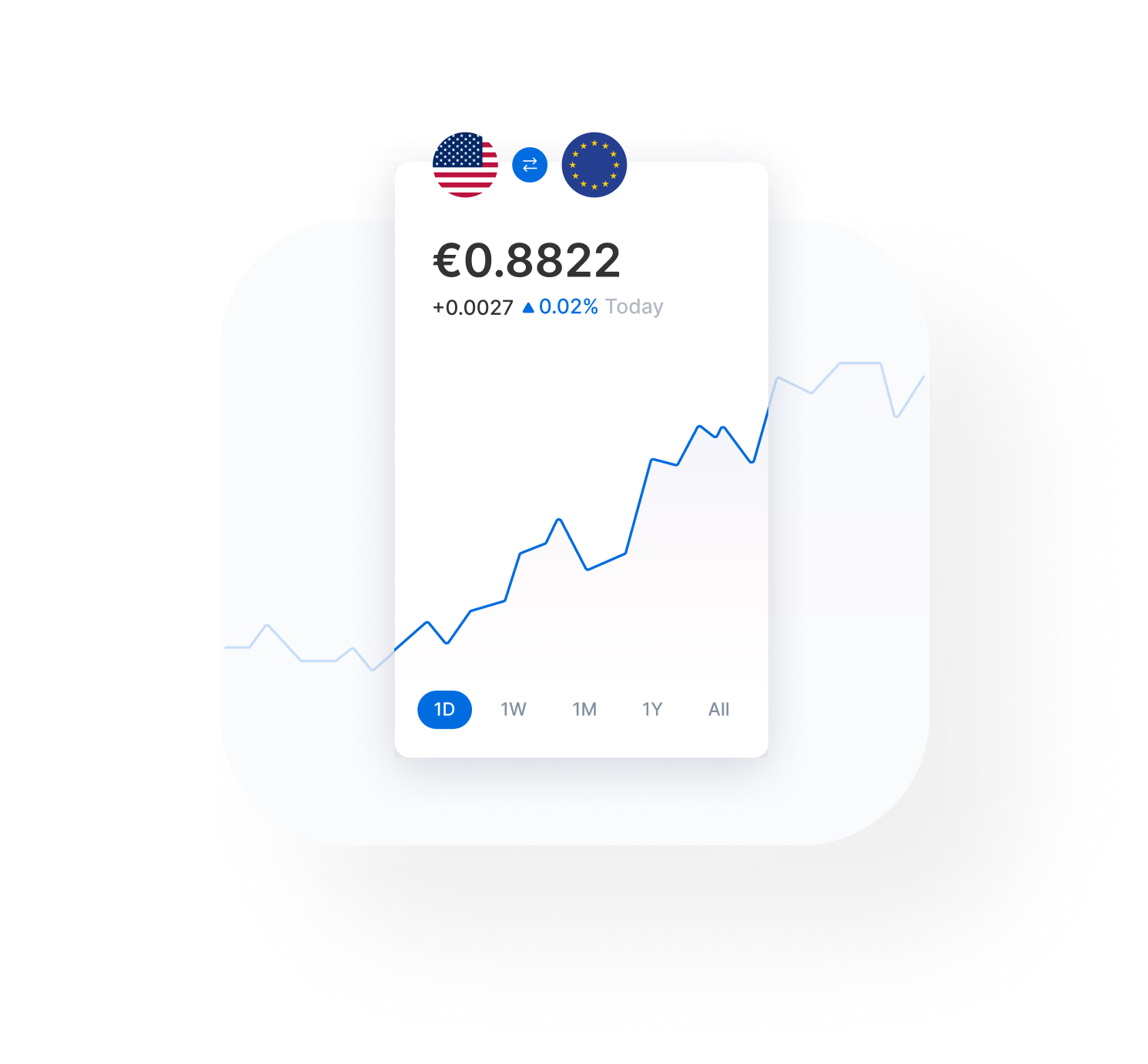

Effective identification of rewarding exchange opportunities is necessary for enhancing financial gains in the realm of money trading and investment. One key strategy is to closely keep track of international economic indications and geopolitical occasions that can influence currency worths.In addition, technological analysis plays a vital role in recognizing fads and patterns in money prices. Using tools such as relocating standards, assistance and resistance degrees, and graph patterns can help traders identify entrance and exit points for trades. Combining essential evaluation with technological analysis supplies a detailed approach to recognizing lucrative exchange opportunities.

Additionally, keeping up with market information and developments is important for identifying abrupt shifts in belief or unforeseen occasions that can influence currency worths (currency exchange in toronto). By remaining alert and versatile, traders can respond quickly to market changes and take lucrative opportunities as they arise

Leveraging Hedging Strategies

To efficiently browse the vibrant landscape of currency trading and financial investment, investors should strategically employ numerous hedging methods to reduce threats and secure versus prospective losses. Hedging involves using economic instruments or approaches to balance out the dangers of negative cost motions in the market. One typical hedging strategy is the use of onward agreements, which permit traders to secure a certain exchange price for a future deal, hence safeguarding them from variations in money worths.An additional prominent hedging approach is choices trading, where traders have the right but not the obligation to acquire or market a money at a predetermined cost within a specified amount of time. This adaptability can assist traders limit their losses while still enabling them to take advantage of desirable market motions. Additionally, investors can use money futures contracts to hedge against currency threat by consenting to market a money or buy at an established rate on a given future day.

Surveillance Economic Indicators

An extensive approach to successful currency trading entails closely keeping track of key economic indications that can substantially influence exchange rates and market fads. Economic indications are important devices for traders to analyze the health and wellness of economies and make notified decisions. Some important indications consist of Gross Domestic Product (GDP), inflation rates, joblessness figures, passion prices set by main banks, consumer confidence indexes, and profession balances.GDP gives understanding right into a nation's financial efficiency, with higher GDP growth usually bring about a stronger currency. Inflation prices impact a money's purchasing power, with lower inflation generally declaring for a currency's worth. Joblessness figures mirror the labor market's health, affecting customer costs and overall financial stability.

Passion prices set by main financial institutions play a considerable role more helpful hints in money worth, with higher rates bring in international financial investment and strengthening the currency. Consumer self-confidence indexes supply a glance right into customer sentiment, influencing costs practices and financial growth. Profession equilibriums show a country's imports and exports, influencing currency strength based upon profession surpluses or deficiencies. By checking these financial indications, investors can better anticipate market activities and maximize their currency exchange techniques for maximum earnings.

Applying Threat Monitoring Approaches

Following a thorough evaluation of key financial indications, the effective execution of risk monitoring methods is critical in navigating the intricacies of currency trading and ensuring optimum end results. Risk management in money exchange includes determining, evaluating, and prioritizing dangers, followed by coordinated application of sources to reduce, keep track of, and manage the possibility or impact of adverse events.One essential risk administration strategy is establishing stop-loss orders to limit potential losses. These orders immediately trigger a trade when a predefined price limit is gotten to, alleviating the danger of considerable losses in unstable markets. In best site addition, diversifying your money portfolio can aid spread danger across different currencies, lowering susceptability to variations in a solitary money.

Moreover, using leverage carefully and keeping sufficient liquidity are essential threat monitoring methods in currency trading. Leveraging allows investors to manage larger settings with a smaller sized amount of capital yet additionally amplifies prospective losses. It is critical to strike an equilibrium in between leveraging for possible gains and handling risks to secure your financial investments. By carrying out these danger monitoring techniques, investors can improve their productivity and shield their capital in the vibrant world of currency exchange.

Verdict

Furthermore, traders can use more money futures agreements to hedge versus currency risk by agreeing to offer a money or get at a predetermined rate on a specific future date.

Rising cost of living rates impact a money's buying power, with lower rising cost of living normally being positive for a money's worth.Passion rates established by central financial institutions play a significant role in currency value, with higher prices attracting international financial investment and enhancing the currency. Additionally, expanding your money profile can aid spread out threat throughout different money, lowering susceptability to variations in a solitary currency.

In conclusion, maximizing earnings through money exchange strategies needs a deep understanding of money markets, the capability to identify profitable exchange possibilities, leveraging hedging strategies, keeping an eye on financial indications, and carrying out threat monitoring approaches.

Report this wiki page